malaysia income tax calculator

RBI Bulletin - September. New rate for Employees.

Everything You Need To Know About Running Payroll In Malaysia

Expatriates that have been working in Malaysia for longer than 182 days in a year are considered tax resident.

. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. This salary calculator is applicable for monthly wages up to RM20000 and shows estimates only. There are a few income tax calculator in Malaysia but my favourite is KiraCukaimy.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Resident individuals are taxed based on a progressive tax rate from 0 to 30 on chargeable income while non-resident individuals are based on a flat rate of 30. Simply input your data and it will automatically calculate your tax payable amount.

Total income - tax exemptions and reliefs chargeabletaxable. Calculate yearly tax Generate piechart for better visualisation Simplified income statement Export result to PDF format and share result easily with anyone by email SMS and other. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF. They are also eligible for tax deductions. The Tax tables below include the tax.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. Expatriates deemed residents for tax purposes pay progressive rates between 0 and 30 depending on their income. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Share Report Trending Downloads. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. RM65850 You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to your total.

First RM50000 RM1800 tax Next RM15000 at 13 tax RM1950. The employees share of the EPF statutory contribution rate was reduced from 11 per cent. However if you claimed RM13500 in tax.

Expatriates that are seen as residents for tax purposes will pay. On the First 5000 Next 15000. On the First 5000.

Download Other files in Income Tax category. Calculations RM Rate TaxRM A. August 2022 On.

Do note that the final. 19 September 2022 Download. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Given the tax rates above you need to remit RM3750 at a rate of 13. This amount is calculated as follows. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Well look at what exemptions you can for the 2021 tax year shortly but for now this is what you need to know. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Malaysia Personal Income Tax Rates 2022

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

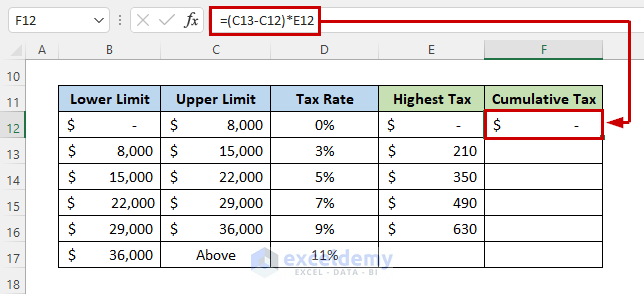

How To Calculate Income Tax In Excel

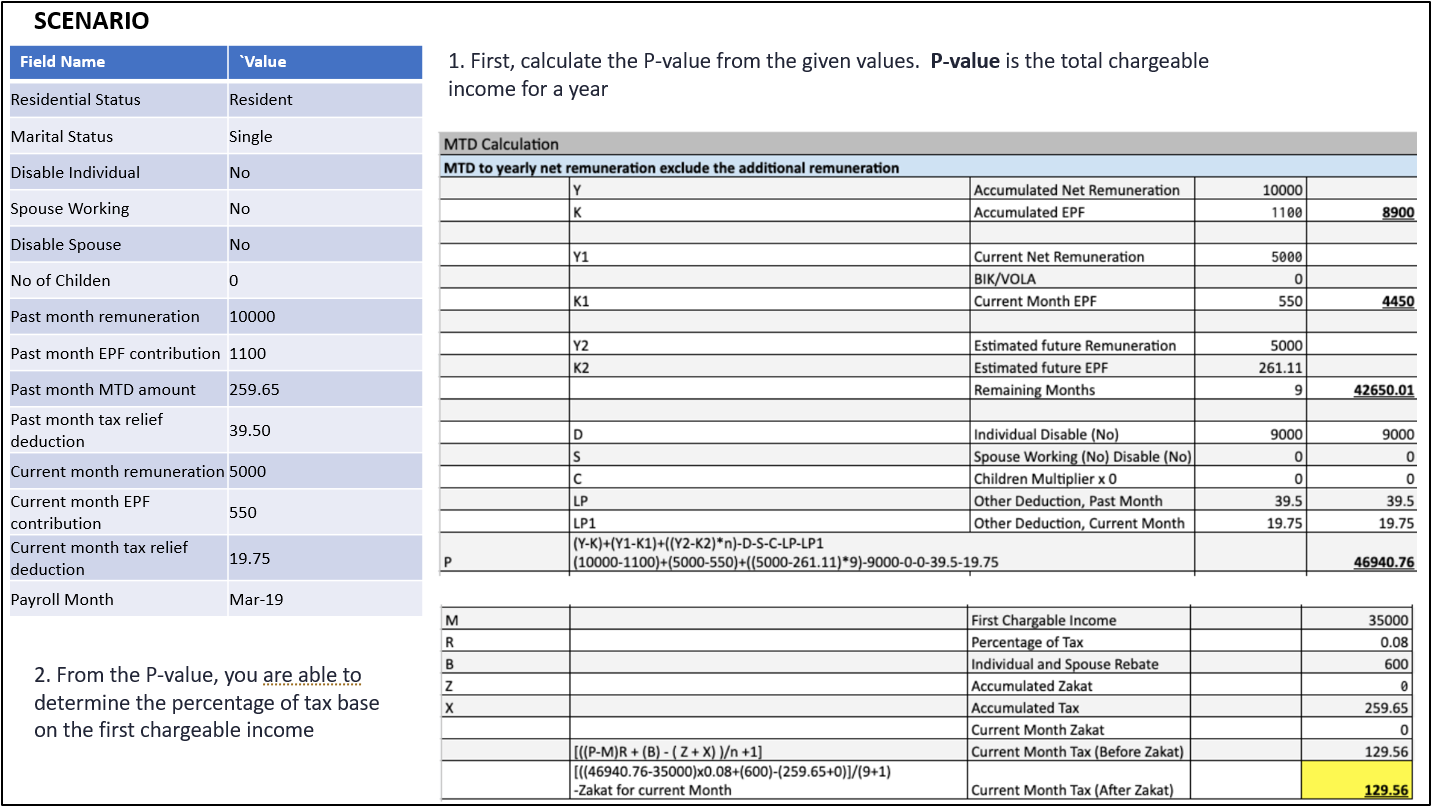

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Taxable Income Formula Examples How To Calculate Taxable Income

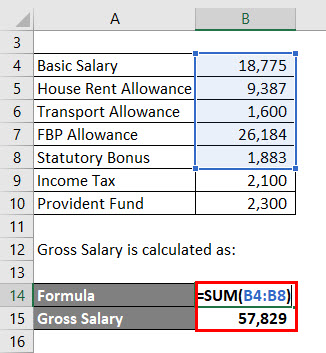

Salary Formula Calculate Salary Calculator Excel Template

Malaysia Budget 2021 Personal Income Tax Goodies

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Computation Of Income Tax Format In Excel For Companies Exceldemy

Income Tax Malaysia 2022 The Complete Income Tax Guide 2022

Income Tax Malaysia 2018 Mypf My

:max_bytes(150000):strip_icc()/2021taxtables-4ebae20de66a4efc98e8bafd951ecb6a.jpg)

Where To Find And How To Read 1040 Tax Tables

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

![]()

Malaysia Salary Calculator 2022 With Income Tax Brackets Investomatica

Comments

Post a Comment